Tax Deductions For Tattoo Artists - Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. You can deduct 50% of any meal expenses you incur conducting your art business. Web tax deductible expenses for artists artists: 812990 you likely decided to. This is a basic list of typical. To deduct the cost of a. Use this list to help organize your art tax preparation.

Use this list to help organize your art tax preparation. This is a basic list of typical. To deduct the cost of a. Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. You can deduct 50% of any meal expenses you incur conducting your art business. Web tax deductible expenses for artists artists: 812990 you likely decided to.

812990 you likely decided to. Web tax deductible expenses for artists artists: Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. You can deduct 50% of any meal expenses you incur conducting your art business. This is a basic list of typical. To deduct the cost of a. Use this list to help organize your art tax preparation.

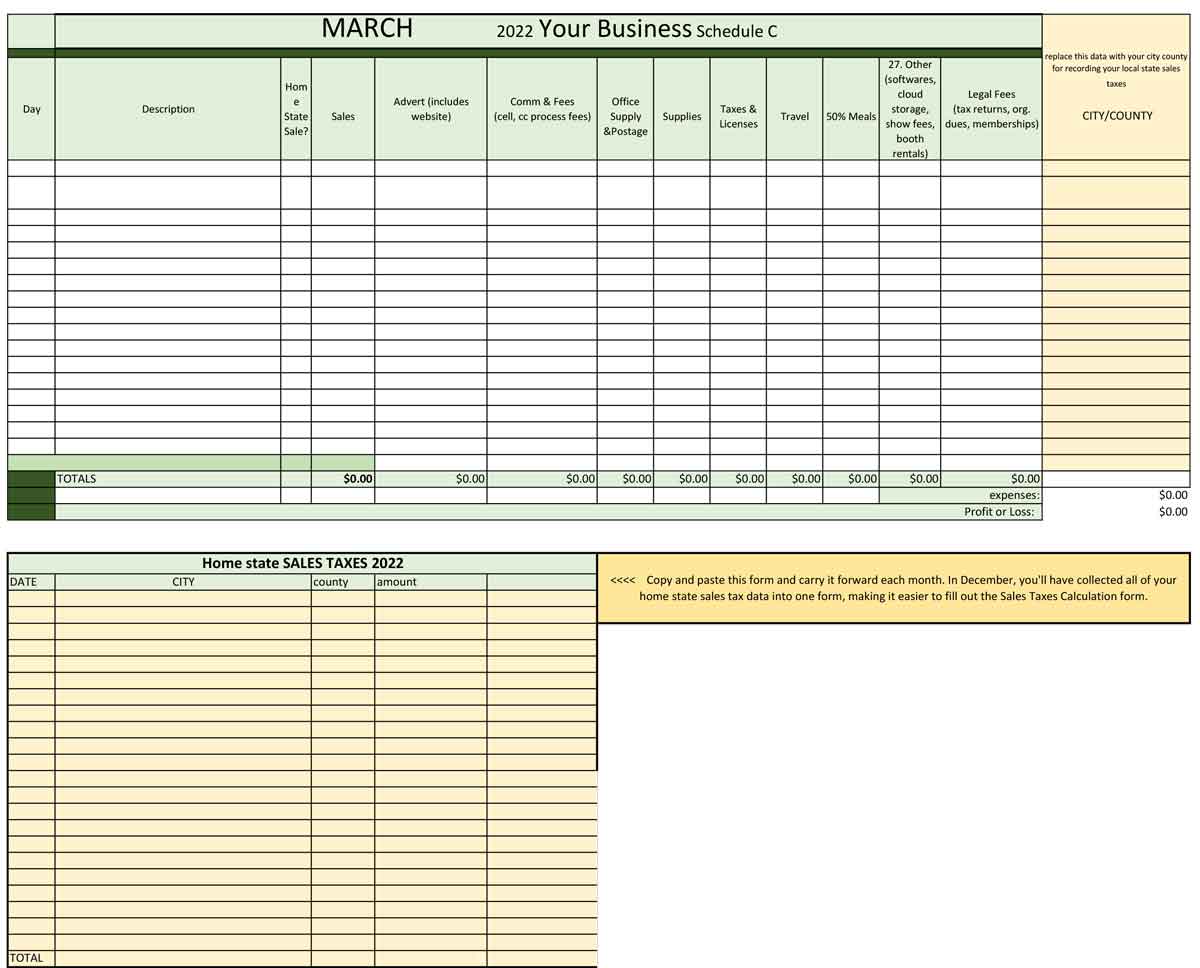

Artist's & Expense Excel Spreadsheet Shop Wild Ozark

Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. 812990 you likely decided to. This is a basic list of typical. Use this list to help organize your art tax preparation. You can deduct 50% of any meal expenses you incur conducting your art business.

The Artist’s Guide to Tax Deductions Creative Economy, Art Studio At

Web tax deductible expenses for artists artists: Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. To deduct the cost of a. Use this list to help organize your art tax preparation. You can deduct 50% of any meal expenses you incur conducting your art business.

Tax Deductions for Tattoo Artists 🖌 YouTube

You can deduct 50% of any meal expenses you incur conducting your art business. 812990 you likely decided to. This is a basic list of typical. To deduct the cost of a. Use this list to help organize your art tax preparation.

Tax Deductions for Artists Infographics Archive

This is a basic list of typical. To deduct the cost of a. 812990 you likely decided to. You can deduct 50% of any meal expenses you incur conducting your art business. Use this list to help organize your art tax preparation.

An Unabridged List of Performing Artist Tax Deductions Small Business

Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. This is a basic list of typical. You can deduct 50% of any meal expenses you incur conducting your art business. To deduct the cost of a. Use this list to help organize your art tax preparation.

tattoo artist tax deductions muskanofficialaliyapooja

Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. 812990 you likely decided to. This is a basic list of typical. To deduct the cost of a. Web tax deductible expenses for artists artists:

SHOULD TATTOO ARTIST PAY TAX ? YouTube

812990 you likely decided to. Use this list to help organize your art tax preparation. Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. To deduct the cost of a. You can deduct 50% of any meal expenses you incur conducting your art business.

Small Business Creative Tax Deductions (With images) Tax deductions

Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. 812990 you likely decided to. Use this list to help organize your art tax preparation. You can deduct 50% of any meal expenses you incur conducting your art business. Web tax deductible expenses for artists artists:

tattoo artist tax deductions janacartervanjones

812990 you likely decided to. You can deduct 50% of any meal expenses you incur conducting your art business. Use this list to help organize your art tax preparation. Web tax deductible expenses for artists artists: This is a basic list of typical.

26 Tax WriteOffs/Deductions for Independent Tattoo Artists Line

You can deduct 50% of any meal expenses you incur conducting your art business. 812990 you likely decided to. To deduct the cost of a. Web tax deductible expenses for artists artists: Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment.

This Is A Basic List Of Typical.

Use this list to help organize your art tax preparation. Web this will ease the burden a little and you will be able to manage your stress while lowering your tax payment. Web tax deductible expenses for artists artists: To deduct the cost of a.

You Can Deduct 50% Of Any Meal Expenses You Incur Conducting Your Art Business.

812990 you likely decided to.